Your Guide to the Annual Review Process - In an effort to maintain accurate records and uphold eligibility standards, we at the Tarrant Appraisal District (the "district") are dedicated to conducting an annual review of homestead exemptions for residential property owners. This process ensures that recipients continue to meet the criteria for residence homestead exemptions. In this post, we'll provide insights into the review process, application requirements, and the reasons behind our annual reapplication requests.

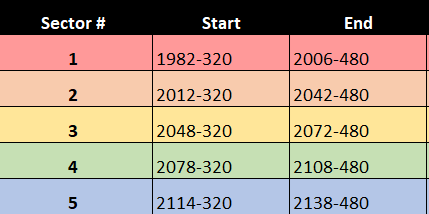

Our homestead account review process is meticulously organized based on map numbers, with the county segmented into sectors. We distribute application packages annually in January, focusing on one sector each year. The goal is to complete a thorough review and verification of all existing accounts with active homesteads.

For the current year, our focus is on Sector 1. The review involves assessing all homestead accounts within the sector to determine whether new applications need to be sent to verify the eligibility of property owners for the homestead exemption.

To streamline the process, we've established an annual schedule for mailing applications, moving sector by sector. Starting with Sector 1, we will proceed to Sectors 2, 3, 4, and 5 each January following 2024. This systematic approach ensures that all accounts are reviewed over a five-year cycle.

For your reference, you can find the TAD map grid

here.

In addition to the annual review process, there are other specific reasons why we request reapplication for residence homestead exemptions. Here are some key scenarios:

- New homestead applications mailed to residential property owners without active homestead exemptions

- Recipients with a last transfer date in the previous 2 years and a matching situs address

- Reapply B Letters sent to residential property owners with an active Disabled Person homestead exemption

- Recipients who are less than 65 years old and have not reapplied in the past 3 years

- Applications will have the letter "B" in the top-right corner

- Reapply E Letters mailed to residential property owners with an active homestead exemption

- Recipients whose mailing address and situs address do not match and have not reapplied in the past 3 years

- Applications will have the letter "E" in the top-right corner

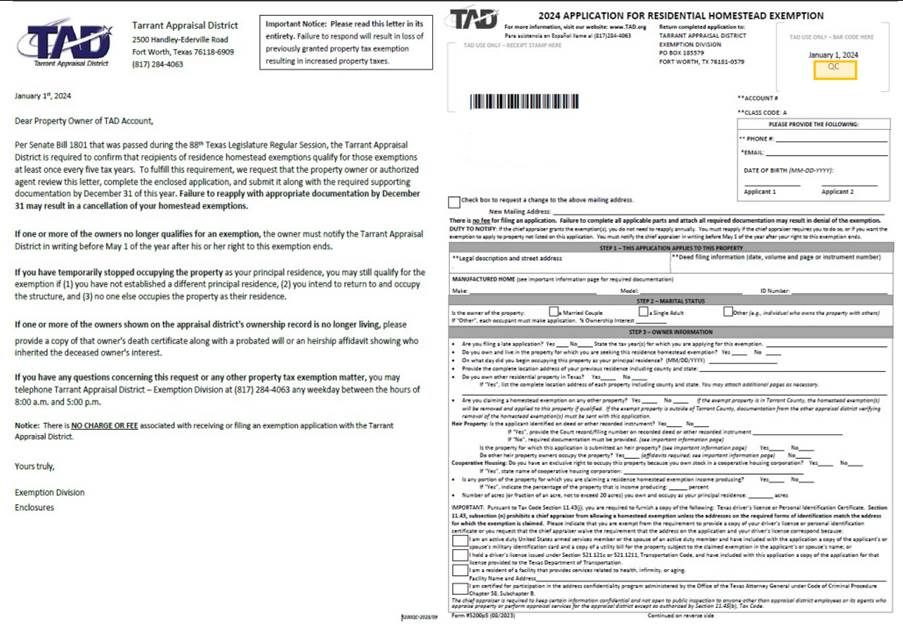

- Fulfills new legislative requirements from Senate Bill 1801, known as the Homestead Exemption Review System (H.E.R.S.)

- Reapply QC Letters to be mailed in January; Applications will have the letters "QC" in the top-right corner

- Reapply QC Letters sent to residential property owners located within specific TAD Map areas in a sector who have not reapplied in the past 5 years

- Reapply R Letters mailed to residential property owners with possible rental history

- Applications will have the letter "R" in the top-right corner

- Reapply T Letters are sent to residential property owners that have transferred their property to a Trust

- Applications will have the letter "T" in the top-right corner

- Requires Qualifying Trust information as per the Texas Property Tax Code

Finally, we're in the process of creating a color-coded map to make it even easier for our end-users to reference information. Rest assured, we'll update the link as soon as the product is thoroughly tested and ready for use.

We understand the importance of maintaining accurate records and appreciate the cooperation of property owners in completing the annual application process. This ensures that homestead exemptions are rightfully granted to those who meet the eligibility criteria. If you have received an application package, we encourage you to submit it by the deadline listed in your package to prevent the cancellation of your current exemption. Should you require any additional assistance or have further inquiries, please don't hesitate to call

817-284-4063 to speak with one of our knowledgeable exemption specialists. Thank you for your continued cooperation in making our homestead exemption program a success.